Gold has been an emblem of wealth and a protected-haven asset for centuries. In instances of economic uncertainty, many buyers flip to gold as a means of defending their wealth. In case you are considering buying gold, it is crucial to understand the various methods accessible, the benefits and disadvantages of each, and methods to make an knowledgeable decision. This report outlines the most effective ways to buy gold, making certain that you could navigate the gold market effectively.

1. Understanding Gold as an Funding

Before diving into the strategies of buying gold, it's crucial to grasp why investing in gold could be helpful. Gold is often considered as a hedge in opposition to inflation and currency fluctuations. It has intrinsic worth and can retain its buying energy over time. Additionally, gold is a tangible asset, in contrast to stocks or bonds, making it appealing to many traders.

2. Completely different Forms of Gold

Gold may be bought in varied kinds, every with its own advantages and disadvantages. The primary types of gold funding embrace:

a. Physical Gold

- Gold Bullion: Gold bullion refers to gold bars or ingots which might be produced by a acknowledged mint. They are bought primarily based on their weight and purity. Here is more on best place to buy online gold look at our own web-page. Bullion is a well-liked selection for critical traders searching for a considerable investment.

- Gold Coins: Gold coins, such because the American Gold Eagle or the Canadian Maple Leaf, are additionally a well-liked form of investment. They are sometimes more expensive than bullion as a result of their collectible worth and the costs related to minting.

- Jewellery: While not usually beneficial as an investment, gold jewelry can be a way to personal gold. However, the worth of jewellery typically contains a significant markup for craftsmanship.

b. Paper Gold

- Gold ETFs (Trade-Traded Funds): Gold ETFs permit buyers to purchase shares that represent a particular quantity of gold. They are traded on inventory exchanges and provide a convenient way to invest in gold without the necessity for physical storage.

- Gold Mining Stocks: Investing in gold mining corporations can present indirect exposure to gold prices. Nevertheless, this methodology comes with extra dangers related to the performance of the mining company.

- Gold Futures and Options: These are advanced funding methods that contain contracts to buy or sell gold at a predetermined price. They require a deep understanding of the market and are not beneficial for novice buyers.

3. Where to Buy Gold

After you have decided on the form of gold you need to purchase, the subsequent step is to find out where to purchase it. Listed below are some widespread choices:

a. Online Sellers

Online gold sellers offer a large collection of gold products, typically at aggressive prices. Reputable sellers present transparency concerning pricing, purity, and delivery costs. When buying on-line, it is crucial to confirm the seller's repute via opinions and ratings from previous customers.

b. Local Coin Retailers

Local coin retailers can be a great best place to buy precious metals to buy physical gold. They typically have educated staff who can provide insights into the gold market. However, costs could also be increased than online dealers because of overhead prices.

c. Banks

Some banks sell gold coins and bullion, but the selection could also be limited. Moreover, banks may cost a premium over the spot value of gold.

d. Auctions and Property Sales

Buying gold from auctions or property sales can generally yield good offers. Nevertheless, it requires careful inspection and information about the authenticity and value of the gold.

4. Elements to consider When Purchasing Gold

When buying gold, several elements must be taken under consideration to ensure a successful funding:

a. Pricing

Gold prices fluctuate based on market circumstances. It is essential to monitor the spot worth of gold and understand the premiums related to purchasing physical gold. The premium is the markup over the spot value and varies based mostly on the type of gold and the vendor.

b. Purity

Gold purity is measured in karats or fineness. The higher the karat or fineness, the more pure the gold. As an illustration, 24-karat gold is taken into account pure gold, whereas 18-karat gold comprises 75% gold and 25% other metals. Guarantee you are aware of the purity of the gold you might be buying.

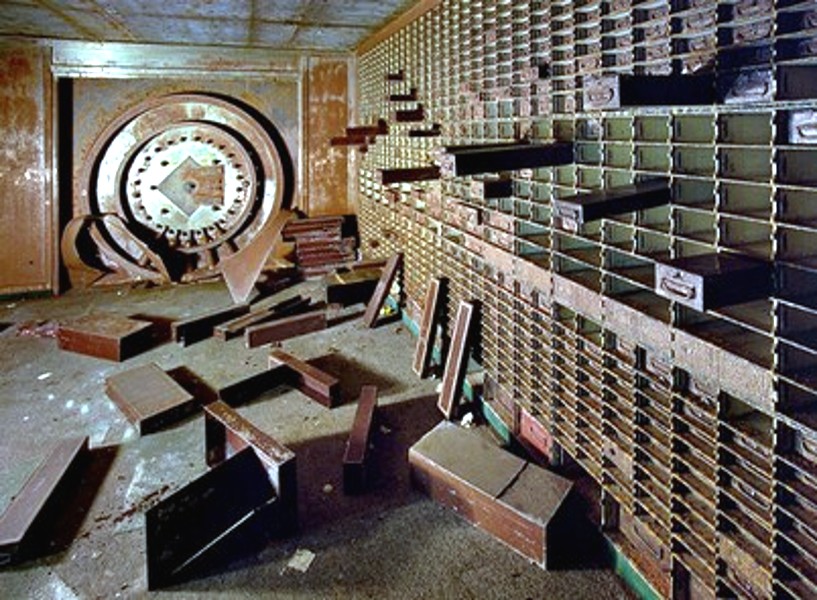

c. Storage and Security

In case you select to spend money on physical gold, consider how you'll store it. Gold ought to be kept in a protected, safe location, resembling a protected deposit field or a house safe. Moreover, consider insuring your gold investment to guard in opposition to theft or loss.

d. Liquidity

Consider how simply you possibly can sell your gold funding if needed. Gold coins and bullion are typically more liquid than jewellery, which can not promote for its intrinsic worth.

5. Conclusion

Purchasing gold is usually a rewarding funding technique, providing a hedge against economic uncertainty and inflation. By understanding the completely different forms of gold, the place to purchase it, and the components to think about, you can make informed decisions that align with your funding objectives. Whether you select to put money into physical gold, paper gold, or mining stocks, ensure that you just conduct thorough research and consider your threat tolerance earlier than making a purchase. With the proper approach, investing in gold generally is a valuable addition to your monetary portfolio.